A random walk between a graveyard and a river

The active management heresy

It was the classic book “A Random Walk Down Wall Street” by Burton Malkiel, that popularised the concept of passive investment. Together with John Bogle of Vanguard, who created admittedly one of the largest and most successful fund management companies since the 1970s they started a movement which now has become the orthodoxy of investment. Approximately half of all assets are in passive strategies compared to maybe 20% a decade ago.

Passive management (also called passive investing) is an investing strategy that tracks a market-weighted index, for example the SP500. The theory goes that no investor however skilled can outperform the market so it makes sense to hug an index and invest long term. The data support this hypothesis, especially if you choose to exclude market crashes.

“Two-thirds of professionally managed funds are regularly outperformed by a broad capitalization-weighted index fund with equivalent risk, and those that do appear to produce excess returns in one period are not likely to do so in the next. The record of professionals does not suggest that sufficient predictability exists in the stock market to produce exploitable arbitrage opportunities.”

-B. Malkiel

I will not discuss the merits or the pitfalls of passive investing per se. I am more interested in discussing the orthodoxy that allocating one’s savings and investments in passive strategies makes sense. This allocation definitely has implications for individual investors but it also has long term unintended consequences not only for the investors but for pension funds, the overall allocation of capital in the economy and finally the fragility of the markets which require every so often saving by central banks. No better time to think about all this than now; in the middle of the largest central balance sheet expansion of all times. And possibly in the eye of the storm.

The passive investment revolution rests on the theoretical basis of the “Efficient Markets Hypothesis”, which in essence says prices reflect all available information. A direct implication is that its is impossible to beat the market legally (insider trading set aside) given current prices will only change in the face of new information. Beating the market is impossible.

How does that work with the latest crisis ? Is the current rally another justification of the hypothesis and passive investing ? Well … yes and no. The fact the the majority of players expect a miraculous V-Shape recovery can explain the last two weeks bull run. The Fed backstopping the markets (including junk bonds for the first time in history) and the government bailing out private companies means people feel safer than ever that their own money is used to prop up the markets. That information is priced in. What looks like not priced in is the non zero probability of the demand side of the equation not matching the supply side quite soon. The market is simply trading as if the outcome is crystal clear.

In my view only the following five things are clear:

This pandemic is of historical magnitude

The economic contraction of this global hard stop is unprecedented

We are witnessing the largest monetary policy experiment in history

The world’s most traded commodity (oil) is collapsing

Globalisation has clearly stalled and is reversing

In my view the uncertainties are still too great be able to say anything valid about the outcome. If you want a good explanation about the recent market moves, the following cartoon by Kal says it all.

So what is the “Market?” How do we define those indices that passive investors track ? Mostly they are capitalisation weighted indices. The larger the cap of a company the bigger the weight it has in the index. And in an interesting feedback loop the more money that goes into an index, the more is invested in the largest companies. In short, the winners are rewarded by an ever increasing capital allocation against other companies.

Hang on a second, what does that mean ? Well it means that the moves we see in major indices are driven by a handful of stocks. Currently those stocks are technology companies. Five or six companies make up the majority of the recent moves in the index. How representative of the US economy is that ? Not very. Would the “market” have snapped back without the Fed’s actions ? Probably not. In fact a lot of under the radar equities are going nowhere. So in summary passive investment focuses on a few winners and really seems to work well when policymakers intervene. Not a very anti-fragile setup !

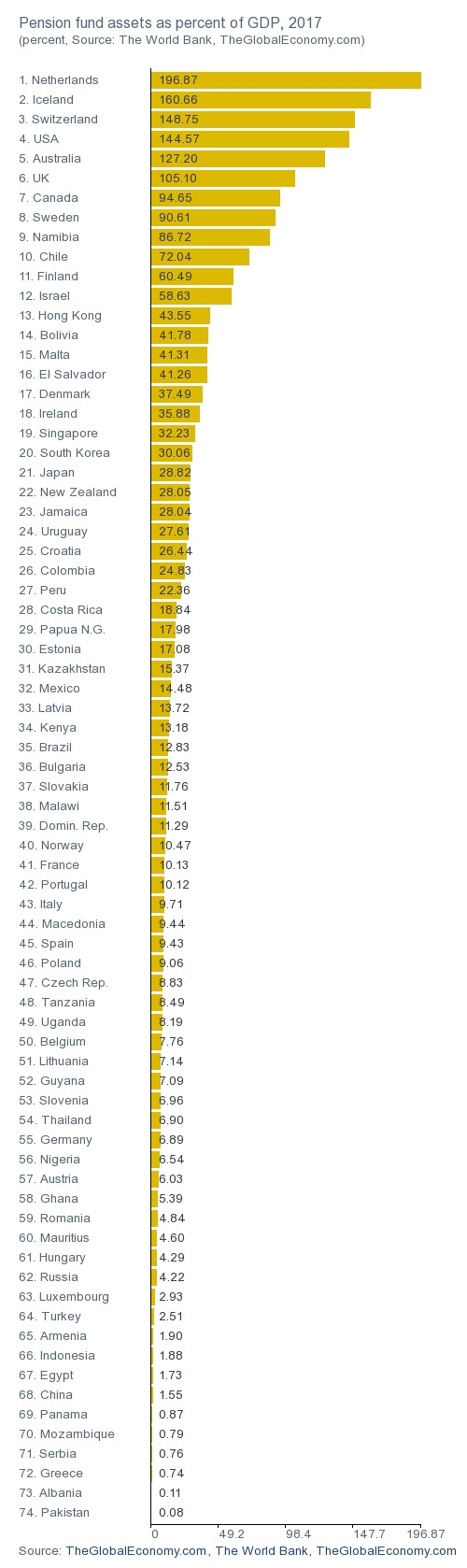

And even if fragility is not problematic in the short term, these passive investment distortions impact the long term outcomes of the more needy pension funds in the world. The ones that do not depend on continuous injections of capital from natural resources but rather have to rely on long term performance to finance their future liabilities. The downside of passive investment not working in a stellar fashion as expected is very large for the weaker members of the chart below. Furthermore, countries that cannot legally just hug US indices in their pension fund allocations do not benefit fully from the proverbial Fed put.

As a parenthesis, on top of the passive investment shortcomings of pension funds, it is clear that by allowing many fixed income zombies to persist they will end up where they will create the maximum damage. But really does it matter ? Money can be printed at will, if we can save bankrupt malls (TALF 2020) I think we should be able to save the pensioners … Another discussion for another time !

Let’s briefly discuss the current equity cycle - how good has passive investment been ? The following chart is from Chartr.

Passive managers have had a great ride in this bull market. In fact only the period of 1987-2000 was longer in duration. Note all three recent crashes were stopped by the Fed (Greenspan put 2000, Bernake put 2008 and now the Powell put). The previous two bull markets started 2 years after each respective crisis, the market taking approximately 24 months of volatile trading to find the right base and to shake off excesses. I really don’t think the market this time has been able to do in two weeks what took two years in much smaller crises…

One of the major benefits of passive investment is that it carries low fees. Indeed some large ETFs have fees in the range of 0.2%. However most ETFs and index products have layers of fees that are difficult to see. And finally most investors are exposed to them via financial intermediaries that really add zero value. Most investment advisors and Robo Advisors buy a few ETFs and charge “advisory fees”. Never to rebalance substantially or ever go short.

And there, to a large extent, the fee discounts of passive investment disappear. How convenient however for the vast majority of financial advisors and long only passive managers ! The underlying ETFs have such small fees they can add a nice markup for nothing. Well almost nothing - some may hold your hand when the market crashes.

In fact the typical 60/40 allocation (60% equities, 40% bonds), that closely mirrors what most passive managers and robo-advisors track, has substantial drawdowns that in recent history would have been much deeper without central bank intervention. So if you are paying any fees to your advisor or fintech startup for this type of drawdown profile I urge you to rethink..

What about the active managers ? The hedge funds, the Wall Street insiders ? Well it looks like most are hidden passive managers !

Giants of active investing like Bridgewater had dramatic reversals in the current climate. To some extent its understandable; you cannot grow to 150 billion without making sure you do at least as well as the indices. And to do that you end up one way or another following them if not directly, then indirectly via the market factors that drive eventually the fund returns.

On the other hand, some bright spots do exist and will continue to exist. Good macro funds, solid CTAs and niche funds managed to thrive in this volatile environment. And then one has to look at assets like precious metals, farmland, industrial real estate, infrastructure, crypto and associated strategies (long, alternative and niche) that will thrive longer term regardless of liquid markets direction.

I think that the liquid equity markets will not move straight back into bull mode. The fixed income market is now fully distorted given the Fed’s actions. This provides a great environment for a come back of active strategies which in my view should be the majority of a portfolio allocation with passive around 25% or so. Fee structures have to change in the active investment landscape to align managers and investors better. I think this alignment of interests is what will accelerate the shift back to active management and outside the “heretics” circle.

For reference here’s the 2008 net performance of a quant trend following CTA I run personally, ICM Diversified. A 60% outperformance differential in difficult markets. This what true active investing is all about: not just good returns but returns that fortify your portfolio in tough times.

Fixed Income: Don’t fight the Fed. Decent risk reward high yield names are interesting. Avoid CCC still.

Metals: Silver is worth a look - the ETF is SLV.

Alternatives: If you don’t own a CTA (trend follower) it is time to think of adding one or utilising that philosophy for partial rebalancing of your portfolio.

Currency: DXY trading at an ever decreasing range - a breakout is imminent.

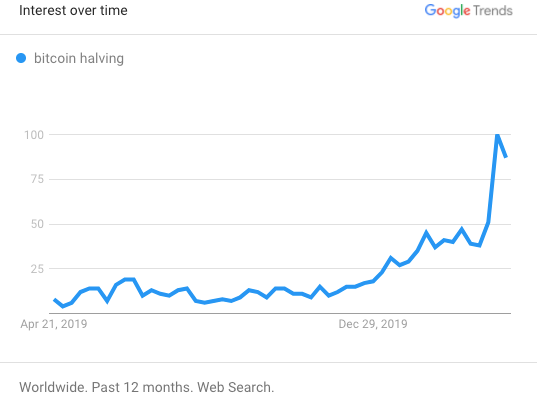

Crypto: Bitcoin halving event in May - buy the rumor sell the news ? Bitcoin goes through a process called halving every four years. The bitcoin algorithm reduces the reward per block mined on bitcoin’s blockchain by half, essentially halving cuts the pace of supply expansion by 50 percent every four years.

The amount of retail interest as evidenced in the google trend search for “bitcoin halving” makes me feel that a lot is priced in already, however I would not rule out a squeeze higher if risk-on mode in fiat markets continues.

“I remember almost exactly how I felt and what I saw my first day at Salomon Brothers. There was a cold shiver doing laps around my body, which, softened and coddled by the regime of a professional student, was imagining it was still asleep. With reason. I wasn't due at work until 7:00 A.M. , but I rose early to walk around Wall Street before going to the office. I had never seen the place before. There was a river at one end and a graveyard at the other.”

-Liar’s Poker, Michael Lewis

Happy to answer your questions and hear suggestions for subjects to explore. I sometimes post markets commentary on Twitter and some markets ideas on TradingView. Feel free to connect with me on LinkedIn.

I recently have started a Telegram channel where I post intraday live news and ideas and you should join it at t.me/entropycapital if you trade more actively or want to hear more ideas than the weekly newsletter.

In these times of uncertainty I am happy to offer all my newsletter subscribers free private 30 min consulting sessions on their portfolios & strategies. Not investment advice but rather strategy building. You can book a slot on my calendar here. I will keep this option open till the end of April.

If you find this newsletter useful or interesting, and want to show your appreciation, the best way to do that would be to sign up, share it on your social media, or forward it to someone you think might get some value out of it.