CBDC

Novus ordo seclorum

Central Bank Digital Currency. Not Bitcoin. Not Ether. Not any of the altcoins or s***coins. Not even CBD.

CBDC will be on your reading list and probably on your phone sooner than you think.

CBDC is essentially electronic money issued by sovereign central banks. It is legal fully state backed e-money. There is a very interesting paper by the BoE on the introduction of CBDC in the UK. However, as global central banks are debating the issue China has already started live testing. And the implications are enormous.

Before any discussion of CBDC lets look at some well known but still startling statistics:

The US population is just 4% of the global population

The US GDP is only 15% of the global GDP

The US Dollar is the currency denomination of 40% of global outstanding debt

The US Dollar is over 80% of all global trade

The USD crosses are over 90% of global FX trading

Having settled on why currently there is really only one reserve currency of significance in the world it may be a bit clearer why a digital yuan or other central bank digital currency could impact this equilibrium. As briefly discussed in a previous newsletter on global geopolitics, the outcome of the global confrontation will largely be a war over monetary dominance and determined by who controls the reserve currency. This is not lost on the Chinese Party. It is also not lost on other big and small players that feel the power and leverage of the US sanctions on their banking matters daily.

Despite the hopes for cryptocurrency and in particular for Bitcoin to be a stateless global currency it is unfortunately not the case yet and may never be for a number of reasons. A Chinese backed stablecoin however is a different matter. It would be a state liability and unlike bank deposits that are the liability of private firms (guaranteed up to a certain level by the state), it would be as good as cash for unlimited amounts. But safer, faster, cheaper to transact, peer to peer. It would also be totally trackable by the state.

I guess participants will choose their poison; unlike fully decentralized private volatile unbacked crypto there will be easily traceable state and commercially backed stablecoins. Potentially in this new world, hybrid community currencies can become significant forces as well; some with geographic limits and some within globally well defined activity groups.

If I had to take a bet I think the user experience will dwarf any privacy concerns and the winners will not be dictated by regulation but rather by trust. Can I trust the value of what I hold in my e-wallet ? Can it meet easily and with safety my needs and can I convert it and exchange it without friction and without price volatility? These questions can be answered in multiple ways by various state and private players. The Chinese e-Yuan is the catalyst; expect a deluge of developments.

Will the Fed come out and establish an e-dollar or the BoE an e-pound ? Will the Facebook nation-state manage to do that (semi) privately with the Libra project ? Could Japan with their early legal acceptance of crypto surprise everyone with the digi-Yen ? Or maybe the IMF creates a supranational super-SDR for global trade ?

The introduction of CBDC has one major downside that has kept development slow by governments. It is the banking sector and the availability of loans. In a zero rate world why would anyone deposit in a bank and not with the central bank ? When that happens however, loans to support the economy will dwindle. That fine line is not lost on policy makers. Crowding out of bank deposits can be easily avoided in a non zero interest rate world; CDBC could be set to yield zero while deposits have interest. Given the Japanification of global rates however it is unclear if this strategy can work in large parts of the world; all in all a great monetary experiment.

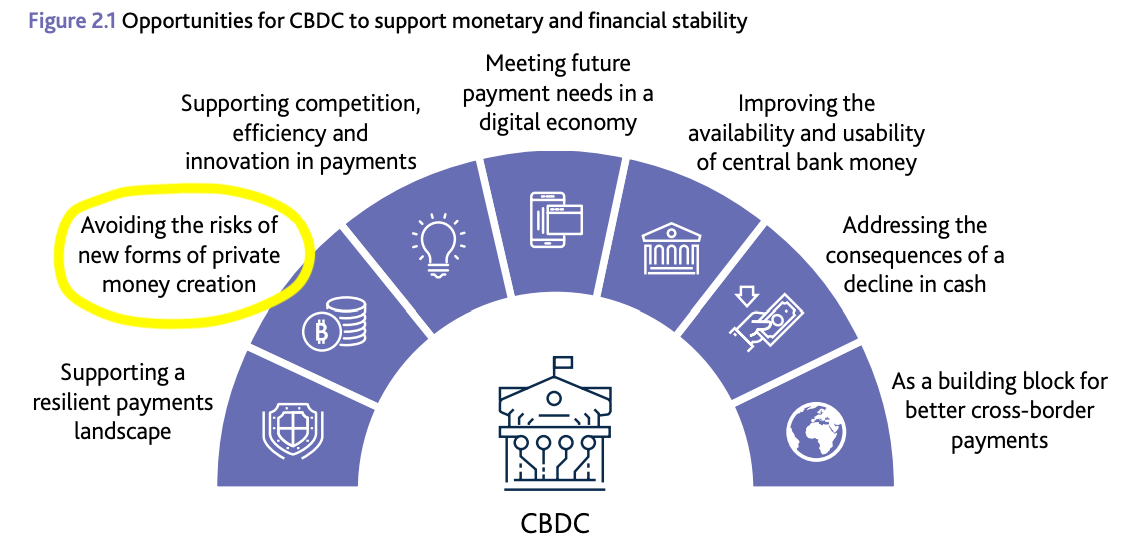

Central banks have given multiple reasons on why they are looking at CBDC now. On the slides by the BoE however only one reason really stands out. The rest are cosmetic. Fiat money is on shaky grounds. Global fiat debt is exploding to dizzying heights. Gold is an alternative but not a viable solution for most. Crypto is also an alternative but too volatile. More and more people understand that their faith on a fiat currency is just that; a faith.

Central banks have to retain their long term significance and power to keep the monetary wheels in motion while inflating like crazy their balance sheets; the only way forward is via digital money that can spread widely and fast. An illusion becomes a reality when a lot of people believe. And central banks need people to believe right now more than ever. Central bank digital currencies are a solution for everyone from Manhattan to the remotest areas of Africa. And if they are backed by the state, as a bonus they help keep the global debt ponzi scheme alive and kicking.

The path for the unfolding of the above is unclear but the end result is uncomplicated. A war on the dollar as a reserve currency is underway and the nation or nation-states that can create the next generation of borderless stable money will dominate the global leadership race.

“Novus Ordo Seclorum” means “A New Order of the Ages”. It is printed on a widely circulated physical green piece of paper which currently anchors the global economy.

I am an experienced finance and technology professional with a 25 year track record in global financial markets quantitative macro trading, portfolio management and deep technology startups.

You can find me from time to time on Twitter and also occasionally playing with charts on TradingView. Looking to connect with driven and action oriented individuals in finance and tech that enjoy building and collaborating on non-zero sum, positive impact projects.