Entropy : From Order to Chaos

2020 : A crisis unfolding

Deciding to start a markets newsletter in the middle of the biggest financial crisis of the last decades, even maybe since 1929, is either going to prove a decent idea or totally idiotic. No middle ground. I hope I can share with you some thoughts that may help you navigate high uncertainty regimes like the one we are experiencing now and will probably continue to experience for a few quarters at least.

Having navigated as a professional trader high volatility markets a few times over the last 25 years, there are three things that I can say with certainty :

Bull markets have their unique characteristics as assets are not fully correlated continuously and it is difficult to predict factors and themes that will drive excess returns. That is one reason why passive investing outperforms in bull markets like the one we had since 2009. On the other hand, crises like the one we are witnessing now, share more common characteristics : drive to liquidity, anxiety about solvency, high asset correlations, rapid asset repricing, relatively well understood domino effects and uniformity of participant sentiment.

Every crisis presents new opportunities. The opportunities appear across the spectrum of assets (private and public), catalysed by what can only be described as brutal economic “natural selection”.

You can only play long term as a market participant and extract outstanding returns only if you understand point (1) and have the patience and firepower to deploy capital for point (2) when needed.

You will be reading a lot more informed expert opinions on the Coronavirus than what I can offer, so I will just add here a couple of charts that will be driving sentiment.

The above chart shows the cumulative confirmed cases (source : JHU SSSE). That doesn’t look that bad . All these non-red areas are not affected. Seems relatively contained. Then you have the following chart, which is not widely shared and for good reason. It is morbid.

Looking at this on a linear or log scale, it is clear the deaths are accelerating - for now. Its not “just the flu” and a vaccine is at best half a year away. The number of deaths, while tragic, is not the point I am trying to make - what is important is the fear this curve acceleration creates among consumers, businesses and policymakers. The number of deaths drive fear, not the number of cases.

“Fear is the mind killer” - Frank Hebert, Dune

On one hand the virus has not yet spread everywhere. China seems to have it partially under control. On the other hand the spread has just started in other parts of the world and it is clear that the initial exponential growth is just starting in large populations like the US and India. Coupled with an unprecedented global monetary response (more on that later), we have markets far from equilibrium where the sentiment of fear dominates and uncertainty is extremely high.

Markets have experienced the fastest crash of all time in the last few weeks. During previous crises like 2008, the falls were nowhere near as violent. We have seen major stock indices enter bear market territory in less than a month and major commodities like crude oil and some sectors drop by over 70%. While recession is still amazingly debated in some circles, it is almost certain a sharp recession is already underway.

Looking at partial data, which is bound to get substantially worse, we see the tip of the iceberg. The following chart will be an order of magnitude more dramatic over the coming weeks.

The number of US jobless claims are already at the levels recorded at the depths of the 2008 crisis. Note the speed of increase vs 2008, where the maximums were recored a year into the crisis. We are only one month into this crisis.

What has made this downturn much more violent are the excesses of the last bull market. The policies of easy money and the willingness of central banks to smother any kind of hint of correction or volatility have left the world more in debt than ever, levered to the max, chasing ever dwindling returns in fixed income markets while driving up stock prices relentlessly for over a decade. At the same time the majority of capital is allocated primarily in blind passive investing strategies, run by a new generation of asset managers that may have read about 2008 at college.

My favourite chart is a stock which is close to my heart (being a space geek), Virgin Galactic. A company which has admittedly the great mission to send tourists to space but however zero current earnings and not a single successful return flight with paying passengers, grew to over 6 billion dollars market cap in the space of a month ! Then it came back to earth…

I have no view on the long term prospects of SPCE, however it shows in a nutshell the excesses of the bull market that accelerated just before the big fall. Commission free mobile trading apps (not really free but that is another story altogether on HFT payment for order flow), social media noise, hedge funds (that do not hedge) buying stocks on margin, and a general strategy that any dip gets bought. There is no downside in owning risky assets like zero income rocket tourism companies, is there ?

And then there is a much bigger problem, a problem that is relatively invisible to retail investors but will determine the outcome of this crisis. Corporate debt globally has ballooned beyond belief. Along with central bank balance sheets, companies across the world have tapped the markets to raise low cost debt reaching levels above 100 trillion dollars for private non financial sector obligations. A large chunk of that debt will be hard to refinance in the coming downturn, pushing a large part of those borrowers at risk of default. This fact was not lost to fixed income market participants.

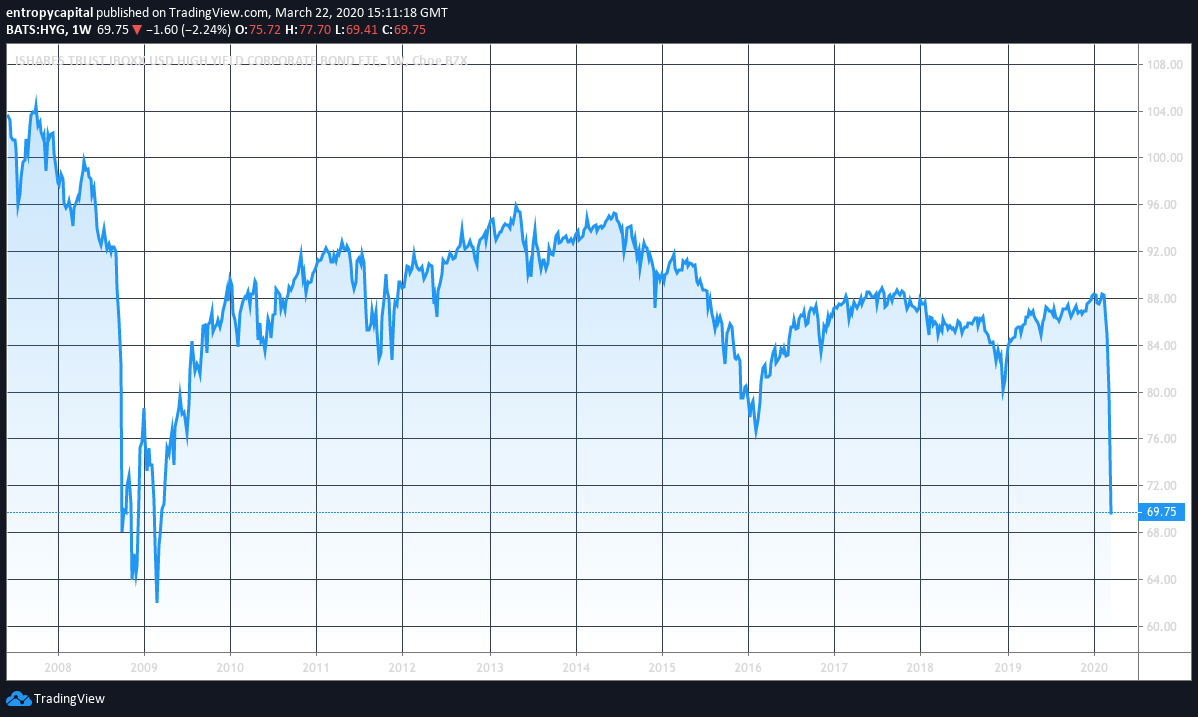

The HYG ETF (High Yield Corporate) is where it was 10 years ago. Debt markets will lead the equity markets. Approximately half of corporate debt is BBB rated. Any changes to outlook or rating will force further liquidations as it moves outside the holding mandate of many asset managers. So even if banks are not as exposed as they used to be to corporate debt, a self-reinforcing liquidation cycle is still possible if not probable. The proverbial canary in the coal mine is in fixed income.

So what happens with the money every central bank in the world is printing ? Won’t that save the economy ? Why worry ?

There will be trillions of currency printed. Central bank balance sheets will balloon to extraordinary size. Assets will be bought, including ETFs and equities. Funds will be bailed out. Banks will be kept solvent. Consumers will receive direct money, a precursor to wider deployment of Universal Basic Income (UBI). Taxes will be deferred. Policymakers have promised to do “whatever it takes”.

The muted market reaction to the above shows that the combined demand and supply shock of the virus, on what was a fragile and overstretched market, cannot be reversed by monetary policy alone. Unlike 2008 where we had a financial crisis only, we now have an existential crisis: a medical ultra urgent crisis on one hand and longer term a structural change in how the market operates as well. Rates are at zero and in places negative but that won’t stop fear. And as long as a large part of the world is in lockdown then the economy stops to move, rates at zero or not. Liquidity won’t come back for some time in the markets.

What policymakers can and will achieve, is to support short and medium term the functioning of the flows of money in the system and the main supply chains. We will not see systemic blowups probably. The rate of market declines will be reduced and volatility will be muted a bit. Central banks will kick the can down the road.

So how do we trade this ? Sell, buy, liquidate and stay on sidelines, stay put and pray ? What about the economy ?

In no particular order :

Equities: Further room to correct, previous dislocations of this magnitude brought corrections of 50% or so, so there is more room to adjust. A sell/fade the bounce regime still in place. The long term trend has broken so bull market strategies won’t work for some time. You may want to rethink your Robo Advisor if you have one. Levels round 2000 on SPX are interesting - see log chart below.

Bonds: If you hold non junk debt it may be about to be junk soon. If you hold western government bonds you hold at best an alternative to cash with bank run insurance if you have amounts over the bank deposit guarantees. Might be a heresy but Chinese and some EM bonds look attractive on relative terms. About to become an interesting playground and the first to indicate the end of the crisis.

Volatility: It’s a good sell, I see VIX trading in a higher regime in the 30s but not at the highs we saw recently.

Hedge Funds: Is there really a hedge ? March Q1 performance figures and resulting redemptions will show who has been swimming naked. If there is no hedge get out and allocate to true diversifiers like quant funds, CTA, niche strategies and illiquidity immune themes. If you are in high yield strategies beware of gates and other nightmares.

Commodities: The Good, The Bad & the Ugly. Gold good (on a relative basis), Oil bad (on an absolute basis), Agriculturals ugly (but lovable). A major long term theme we will explore further as it is also linked to the US dollar and geopolitics.

FX: The world is quite short of dollars currently and the Fed is providing swap lines to central banks like there’s no tomorrow. If long stay long USD, if not, get some exposure. It’s a long discussion and if there is interest will do a post.

Digital Assets: The liquidation of bitcoin losing 50% in 2 days demonstrated that digital assets are not yet a good store of value let alone a “safe haven” despite YTD outperformance. Having said that, they are inevitable and will play an increasing role in portfolio allocation. A subject of a full post as well.

Real Assets & PE : The fact there is no frequent mark to market does not mean they wont be affected. I think private equity funds will suffer more as they have relied on cheap debt and subsequent target deleveraging to extract value. Real assets should hold better while the whole world is printing money.

Economy : We will go into a recession. It will be deeper than most expect but hopefully shorter than many fear. A lot will depend on the length to find a cure and the collateral damage in balance sheets till then.

Cash is KING: Having cash at hand in the next 3-9 months is the biggest single thing you can do to pick up on the juiciest distressed opportunities; there will be many and usually appear once every decade or longer.

Entropy is a measure of uncertainty and disorder. In my view, it is fundamentally a better way to think about risk and opportunity than the classic standard deviation measure of volatility. Markets have “fat tail” distributions. We just witnessed what people describe as “black swan” events or 5/6 sigma moves. What happened is a manifestation of long simmering tensions in the system. The fact that one cannot observe "entropy” does not mean it is absent. Low volatility fooled the majority of investors in a false sense of security the last 10 years.

In the words of famous physicist Carlo Rovelli, entropy is subjective. And despite the fact that he is focused on the physics of time, his analysis applies to investments and how we interact as participants in the complex adaptive system we call capital markets.

“Order is in the eye of the person who looks…the distinction between past and future, the growth of entropy over time, depends on a macroscopic effect…the way we have described the system, which in turn depends on how we interact with the system.” - Carlo Rovelli

I am looking to send weekly updates on more focused themes and opportunities as the crisis unfolds and I would love to hear your questions and subjects to explore. I post sometimes quick markets commentary on Twitter. Feel free to connect with me on LinkedIn.

In these times of uncertainty I am happy to offer my newsletter subscribers free private 30 min consulting sessions on their portfolios & strategies. Not investment advice but rather strategy building. You can book a slot on my calendar here.

If you find this newsletter useful or interesting, and want to show your appreciation, the best way to do that would be to sign up, share it on your social media, or forward it to someone you think might get some value out of it.

Till next week - stay safe !

Excellent and original

Very nice & thorough analysis George !