Exchange Traded Fun(d)

The joys and perils of tactical asset allocation

Tactical asset allocation (TAA) is the bread and butter of most investment advisors. The 60/40 portfolio (60% bonds & 40% stocks) is a subset of the potential TAA strategies where a portfolio of asset classes, primarily bonds stocks and cash are used to provide some balanced exposure to the markets. Sometimes these weights are rebalanced periodically either on a fundamental basis, a quantitative basis or more often than not when they maximize fees for the investment advisors.

The aim for TAA is theoretically to manage the risk return profile of a portfolio so as to maximize investor returns while reducing risk. TAA is theoretically what gives investment advisors their edge over a simple passive index investment and is used to justify fees for robo-advisors. Most portfolios are built using exchange traded funds to give access to passive strategies and easy rebalancing options. Some however do actual security selection on various factors trying to outperform the market on a risk adjusted basis.

It is important to ask the question: What exactly is better risk adjusted performance ? Some would say lower risk for same return without too much thinking.

OK return is clear but how is risk defined ? Again the standard deviation of returns blah blah - is that it ? Lets see some scenarios.

A -10% return has same risk impact as a +10% return - is that reasonable ? (Nope)

Straight line smooth positive returns have low risk due to minimal standard deviation - however they seem to be followed by blowups (option writing) or frauds (Madoff) - but till blowup they look stellar ! (Whatever looks too good, probably is)

A portfolio has constituents that are de-correlated to some extent hence shows good risk characteristics until a crisis develops, correlation goes to one and the portfolio melts down pronto … (always think of worst case correlation scenarios)

Risk in an illiquid portfolio of a REIT or a credit hedge fund is hidden and the daily NAV gives the sweet illusion of liquidity and low risk as small daily returns accumulate. Then unexpectedly the NAV is suspended/redemptions are gated. Just because you cant see the risk doesn’t mean its not there. (if you are on a bumpy flight but you are sleeping soundly in your seat it doesn’t mean the flight is not bumpy).

You have a fully backed commodity ETF like USO. It is supposed to track crude oil. You think you carry crude oil risk only ? Is the variability of crude prices the risk ? Think again. You carry credit risk (somebody is managing the vehicle) and as recently seen you carry futures roll risk plus delivery risk. (find out what exactly you are exposed to).

A portfolio has a 20% loss from the peak (drawdown). Does the recovery time and path change how risky the TAA portfolio is ? In other words, are prolonged drawdowns which are psychologically easier to stomach better ? (answer is no)

Bonds have been less risky as they have coupon payments and in that way “hedged” an equity portfolio. How safe/risky are bonds in a zero rate environment? How do they hedge (or not) a TAA portfolio ? (How much do you trust the Fed or central banks ?)

Is a Trend Following CTA risky if it works really well in the times you need it to do so ? (no - it is one of the best portfolio diversifiers that exist).

Among two return series that have the same standard deviation risk but one is more predictable which one is more risky ? (entropy as a better measure of risk will be the subject of follow on post).

These are some of the questions to ask to your advisor or wealth manager when they are selling you their TAA magic showing you a nice smooth chart going up.

For those that have asked me for a list of ETFs I am providing one below. It is not exhaustive and there are a ton of other similar structures in AMCs (actively managed certificates) in Europe and other structured products. It is a starting point if you want to do your own allocation or discuss allocation choices with your advisor.

SPY : S&P 500/US Large Caps

IWM : US Small Caps

QQQ : Nasdaq

IWF : Large Cap Growth

IWD : Large Cap Value

MTUM : Momentum Factor US

VNQ : US Real Estate

REM : US Mortgages

TLT : Long Treasuries

IEF : Mid Term Treasuries

SHY : Short Term Treasuries

LQD : US Corporate Bonds

HYG : US High Yield Bonds

EEM : Emerging Markets

GLD : Gold

SLV : Silver

DBC : Commodities

There are thousands of ETFs (by some estimates 5000 !), so the above short list is just a starting point for the curious. One needs to consider credit risk, liquidity, tax treatment and transaction costs. Happy to point our specialised ETFs and vehicles that may be of more interest to you.

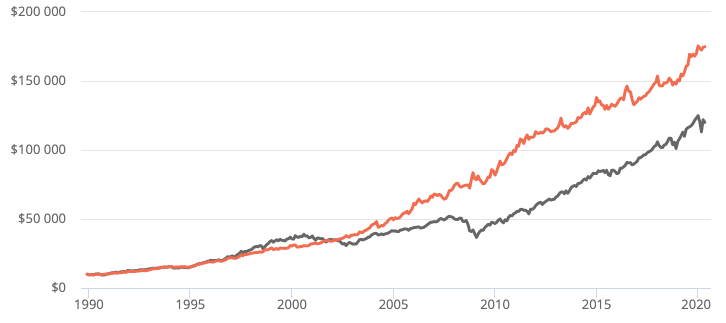

I have included a quick example of TAA curves below. In black, the typical 60/40, in hopeful orange a dynamic quant TAA. If you like the orange curve feel free to reach out. It is never too late to think of the next “unexpected” crisis or leg down in equities.

Some tweets that caught my attention last week :

I sometimes post markets commentary on Twitter and positioning ideas on TradingView and on Telegram. Feel free to connect with me on LinkedIn.

If you find this newsletter useful or interesting, and want to show your appreciation, the best way to do that would be to sign up, share it on your social media, or forward it to someone you think might get some value out of it.