Hope is not a strategy

While the great money printing machine is going Brrr...

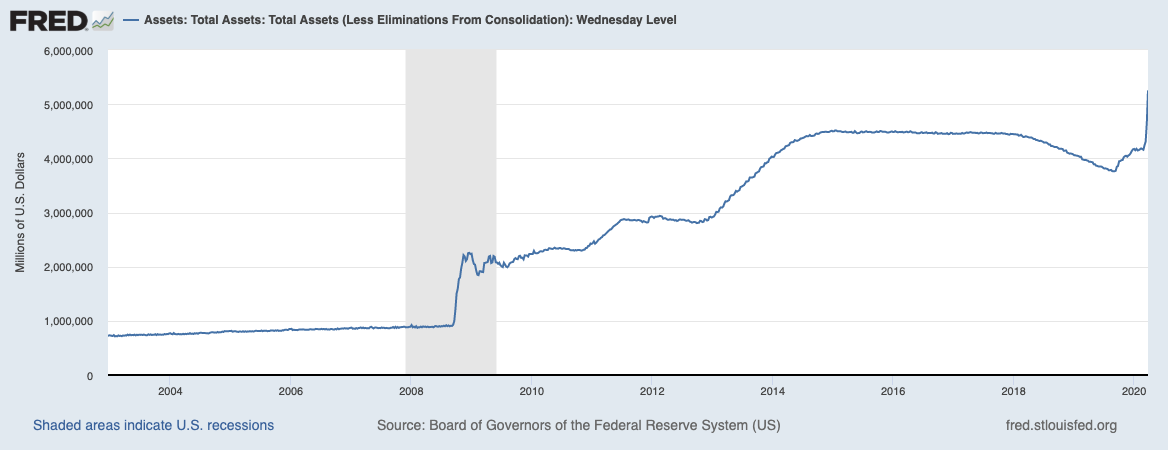

Another volatile week in the markets with the fastest bear market of all times followed by a swift mini bull market. There is one chart that provides the explanation for last week’s amazing price action.

The total asset base of the Federal Reserve is exploding upwards, currently at 5 Trillion dollars. Expect this to balloon to a figure closer to 10 Trillion US dollars in the coming months. The great money machine has started printing. And not just in the US, but globally. The main global central banks have now a total of close to 20 Trillion dollars of assets on their balance sheets, a figure which will increase dramatically. The process of “internalising” various assets and the associated bailouts is just getting started. On that backdrop, this website is getting a lot of traffic recently as people are sitting at home trying to work … Brrr

Central banks have been vocal and rightly so about supporting the liquidity in the system. Anything less than a global monetary flood would have meant instant collapse of global markets, credit meltdown and depression leading to social unrest.

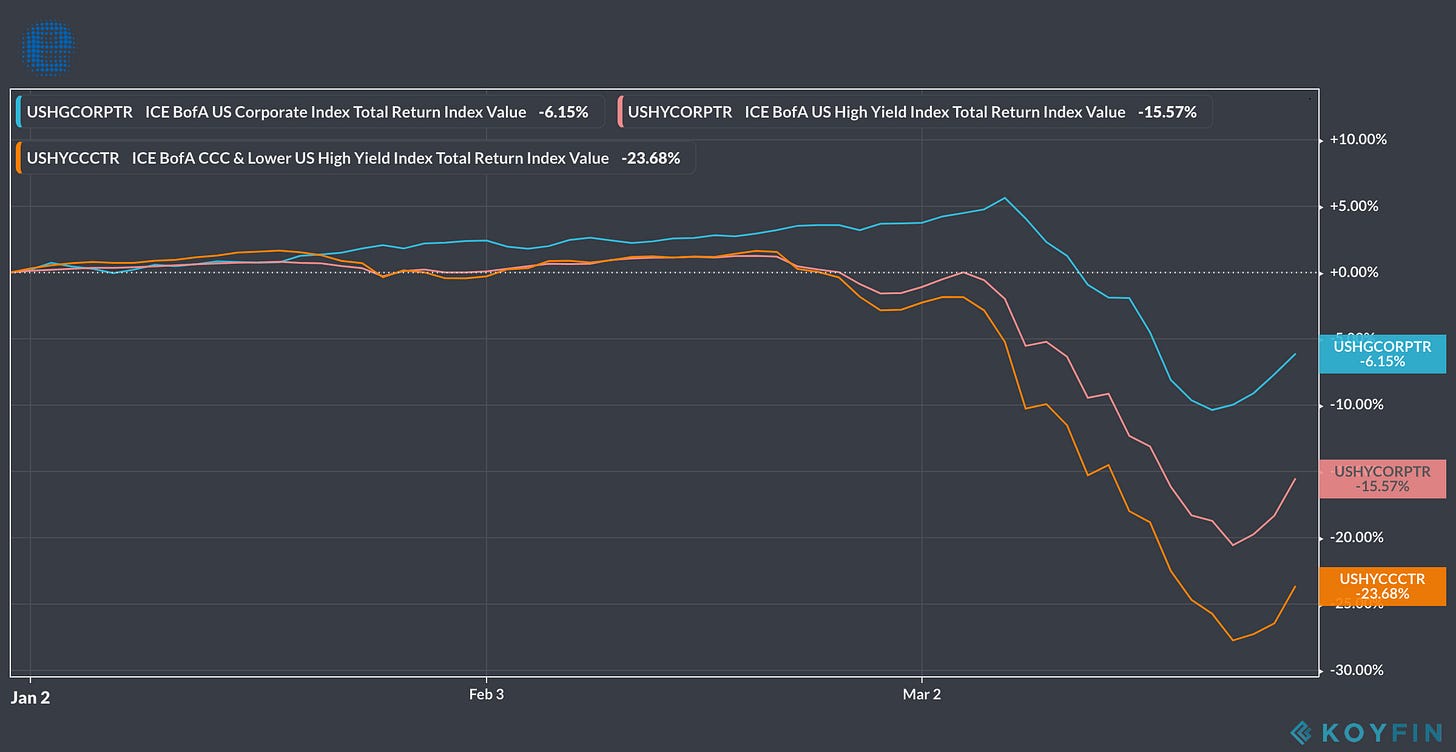

Following this promise of endless liquidity, both debt and equity markets reversed sharply in what I would personally classify as a classic bear market rally : sharp and cross asset at high correlation. All corporate bond indices turned, as the immediate threat of a credit meltdown evaporated. As discussed in the previous newsletter, policymakers have kicked the can down the road.

Ok are we done here yet ? Can we just buy and hold again ? Nightmare over ? Well in terms of the virus not at all, as the situation is just now starting to get seriously exponential in the UK and US.

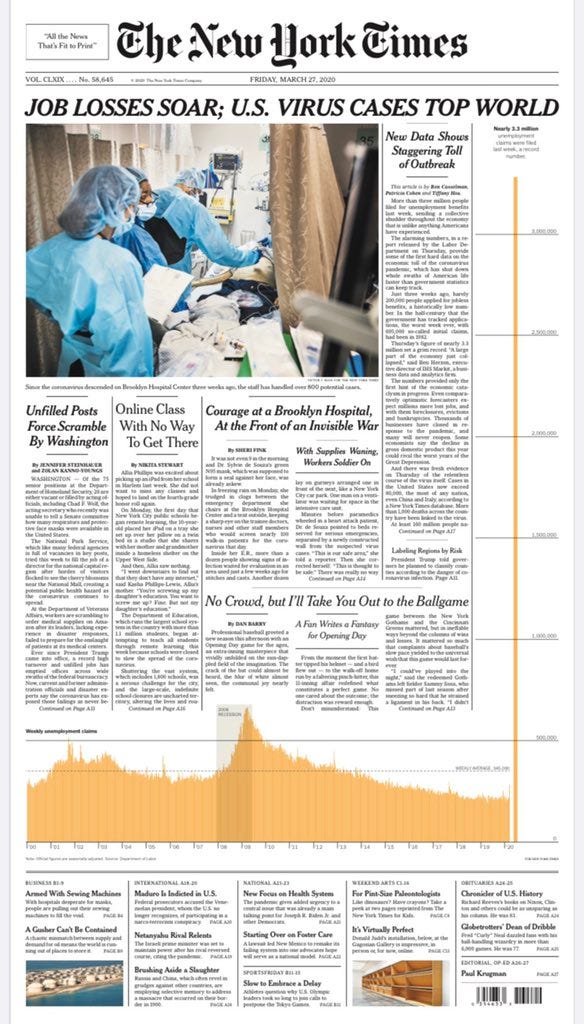

In terms of the markets, we are still not out of the woods. Last week saw the highest print ever of US unemployment numbers at 3.3 million. Just a look at the chart below shows the scale of this anomaly. And it is going to get worse.

The NY Times published a very inventive front page to show the scale of what is happening, an event with no precedent in peace time. Expect the April and May jobless figures to set new highs and these numbers to be absolutely horrible globally.

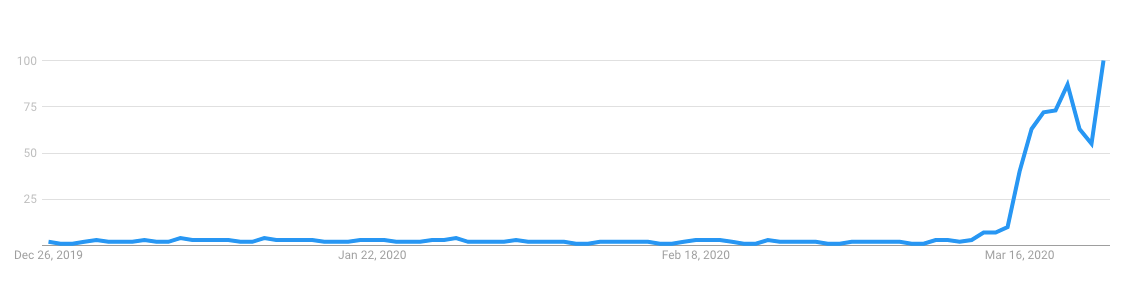

There is good reason to think that many more people will file for unemployment and that even this number was low. Below is a chart for the google searches for “file for unemployment”. As many people try to understand if they are eligible and how to file (don’t forget for many it will be the first time they have to do this), this backlog of claims will show up in the next numbers. A double digit print in the millions is not out of the question.

At the same time the world is grinding to a halt. Quarantines, lockdowns, supply chain disruptions all together with a dose of fear and uncertainty. Global flights are not picking up (despite some recent optimism around that) as the following chart shows.

On the back of this massive demand drop, oil is trading on physical much lower than paper/futures, with cargoes changing hands much lower than what we see on the screens, especially on post April deals. Some traders have indicated prices below $10 for some physical grades.

In terms of consumers, I feel there will be substantial loss of demand long term. It will rebound but a new lower “normal” will be established as households face unexpected income loss, unemployment goes higher, pension accounts are marked to market and housing valuations fall.

Obviously, the fact that the Fed cannot fully solve this problem means that there is a difficult choice societies everywhere have to make : go back to work and balance a bit the economic situation but risk new virus outbreaks or stay at home in isolation, flattening the curve of infections and at the same time extending the depth and duration of the recession. Between the devil and the deep blue sea…

The choices we come to make as societies in the next few months will determine the course of history and how our children will look upon us as a generation. There is no easy answer given the massive immediate uncertainties we face.

In Europe this crisis will determine if the union continues or degenerates quickly in yet another geographic trading bloc. Are Europeans capable of rowing all in the same direction in the face of an asymmetric shock with existential consequences ?

“Under normal circumstances, the two-week delay in agreeing on a response would not be a big deal…But in the current crisis... whether or not Europeans help each other fast in this acute emergency can shape popular perceptions of what Europe stands for - and for a long time to come.”

-Holger Schmieding, chief economist at Berenberg bank

On the positive side, I feel the choices we do make on this great “Global Reset” can overcome many of the problems we saw as “unsolvable” in the past. My worry is that this unique chance may be lost as we collectively try to hang on to what was clearly an unsustainable and fragile past. Unsustainable economically and ecologically; destructive long term for humanity. But that is the subject of another newsletter for someone who writes much better than me.

So with the central banks giving back a sense of hope in the markets, what are the next steps ?

Equities : We had a sharp bear market rally. Until there is clear improvement on the fight against the virus there is value around 2000 to 2100 on SPX but not up here. We need to trade above 2800 to discuss potential return to previous uptrend. Diversify your portfolio - there is value in smaller cap stocks and niche sectors.

Fixed Income : The wave of downgrades is just starting. Stay ahead of the curve as the major index sponsors delay index rebalancing due to volatility; this means passive titanic size asset managers will rebalance 2-3 months late, leaving a spectacular window of opportunity to exit first or trade against them actively.

Commodities : Even here we are in a new era for gold on a relative basis. Long GLD short SPY has more room to make money.

FX : USD long - you know as the saying goes “In the land of the blind, the one-eyed man is king”. What’s the alternative ? Bitcoin ? Maybe but see below.

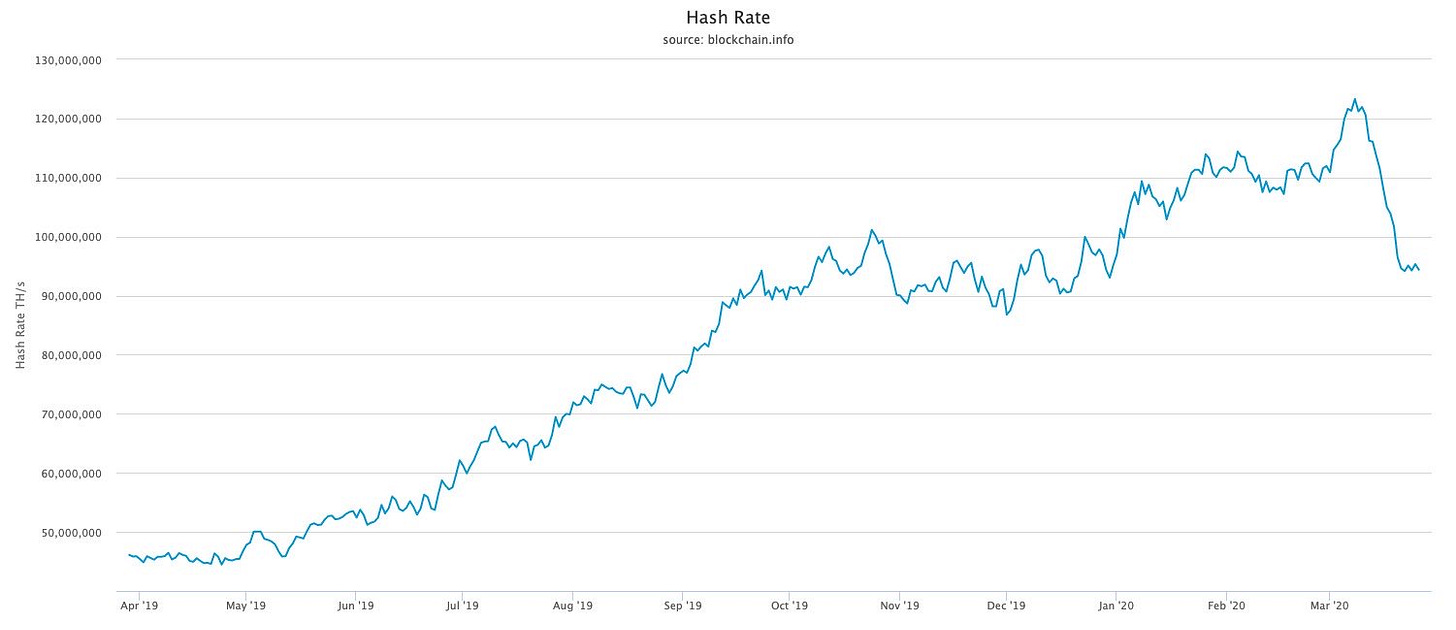

Bitcoin : It is a risk asset clearly and there are worrying indications that miners are getting out. Keep on the radar but not yet a screaming buy, despite the tsunami of money printed and some macro guys thinking it’s the only alternative.

Active vs Passive Investment : Risk Parity is dead. Like in most areas of life you get what you pay for. My former colleague sums up the challenges pretty well.

Given that hope is not a strategy and the money printing machine has kept the markets open … act now.

“A good plan, violently executed now, is better than a perfect plan next week.”

- General Patton

Happy to answer your questions and hear suggestions for subjects to explore. I post sometimes quick markets commentary on Twitter. Feel free to connect with me on LinkedIn.

In these times of uncertainty I am happy to offer my newsletter subscribers free private 30 min consulting sessions on their portfolios & strategies. Not investment advice but rather strategy building. You can book a slot on my calendar here.

If you find this newsletter useful or interesting, and want to show your appreciation, the best way to do that would be to sign up, share it on your social media, or forward it to someone you think might get some value out of it.

Wishing you a great week ahead !