Res tantum valet quantum vendi potest

Will value investing survive helicopter money ?

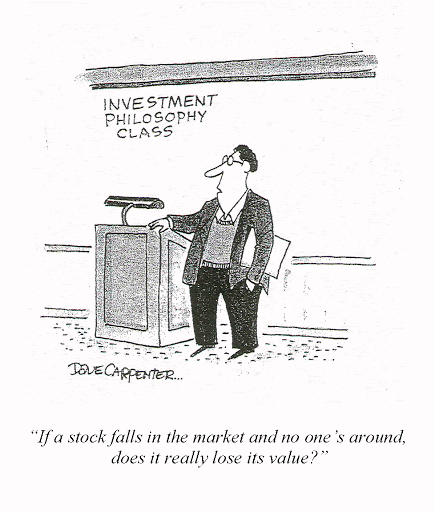

The orthodoxy of investment has always been that over the long term “value” gets repriced in the market; undervalued cheap assets are recognized as informed and unbiased market participants allocate capital in efficient marketplaces; value outperforms. Names like Graham, Buffett and other investment heavyweights have said so numerous time. Right ?

Well … here is a chart of the ratio of growth stocks over value. Looks like two decades where we had two massive trends only to end up more or less where we were back at the turn of the century. Value outperformed growth after the 2000 dot-com bubble burst until the financial crisis of 2008. Rational investors would have expected an acceleration of value outperformance given state of the global economy at the time. Lo and behold growth stages a massive comeback up to date. The fuel ? Cheap money, bailouts, Fed backstop in fixed income markets. Sounds familiar ?

It is even clearer as a historical review, where instead of a ratio we just show return charts. Anyone invested in value stocks not only underperformed growth but seems to have lost decades worth of investment upside …

And the final nail in the coffin: Warren Buffett YTD has underperformed both value indices and growth indices. How is that possible ? The Oracle of Omaha !

There are so many academic papers on the subject and an avalanche of opinions; some more informed than others. I am not here to preach. For one I am not an Oracle.

The Roman philosopher Seneca said : “Res tantum valet quantum vendi potest” or “A thing is worth only what someone else will pay for it”. And here lies the crux of the matter.

Helicopter money will keep favouring growth names. It will also keep volatility subdued (but not risk) and markets extremely fragile to downside multi standard deviation moves. Value investing is not totally dead but I cannot see how it will come back from the twilight zone easily. For one, the new generation of investors (the Robinhood crowd) are “brand” investors without any valuation metrics in mind when they hit the buy button. The older generation will not take risks; their bond holdings are about to yield negative and they will hold on to what is left of their principal. And the rest will hang on for dear life on the passive index strategies (favouring growth) hoping the miraculous Fed put does not expire before they retire.

So what is the value of value ? For choice, I will go with Seneca. It is what most investors will pay for and it currently looks to be a discount to growth. Now and in the near-medium term. And the only way to navigate any potential shift back into value is not hope or belief. Rigid beliefs in investment themes is one of the worst mistakes investors can make. The way to follow and trade back into value is via systematic, quantitatively driven methods of allocating capital between equity factors that have persistent trends.

When the herd votes value, vote with them; not before.

I sometimes post markets commentary along with random thoughts on Twitter. Occasionally I post trading strategy ideas on TradingView or on Telegram. Feel free to connect with me on LinkedIn.