Supertanker Trends

Amara's law expanded

From time to time it is good to leave the analysis of current developments on the side and focus on longer term trends. These trends may affect our way of life in the decades to come as well as determine the long term performance of investment portfolios far more than anything the market may be focusing on right now. Getting straight to the point, the below are in my view what I call “supertanker trends”. Massive, long term, one way currents with dramatically increasing importance over the next decades :

Climate Change

Ageing Population

Global Leadership War

Artificial Intelligence

Digital Assets

Brain Science

What defines a long term trend ? Well for one it is usually not a relatively obscure new subject that gets attention. In all long terms trends the data has been available for many years if not decades. It is the gradual awakening of an ever increasing number people to the direction of the trend that creates the mechanism of wide recognition. There is no “eureka” moment. The pieces of the puzzle are visible to all that are willing to look. The ones with more imagination may recognise it first. But eventually the trend becomes clear for all.

The reason why those larger trends do not become widely recognised earlier is not only a failure of imagination. It is also due to the constant pre-occupation of the human race with what is immediate. The tyranny of short term thinking, quarterly reports, incessant (mostly negative) news-flow and our brain wiring that nature has evolved to recognise short term patterns in order to survive, are all factors to our bias.

“We have no future because our present is too volatile. We have only risk management. The spinning of the given moment's scenarios. Pattern recognition.”

- William Gibson

There is an interesting principle, called Amara’s Law. Coined by Roy Amara, it states that we tend to overestimate short term effects and underestimate long term effects. He spoke with respect to technology but I think the same principle is applicable to most transformational trends. We think linear as our pattern recognition biological inference engine hums along between our ears. Linear is almost never true long term.

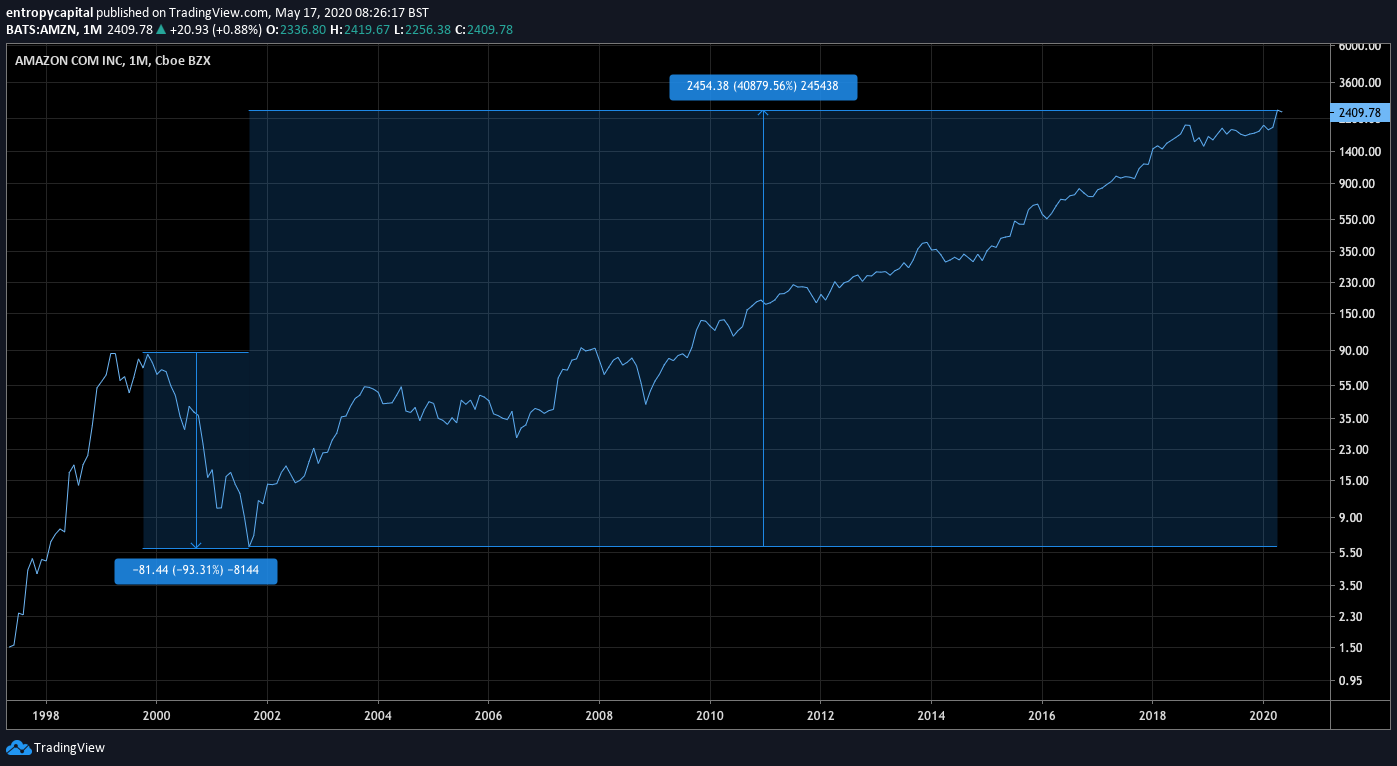

In terms of investing these long term trends present massive opportunities shaped by Amara’s Law but not without risk. As an example lets take e-commerce. When Amazon was starting 20 years ago it was becoming clear technology and the Internet was a long term trend. Looking at the stock price in log scale however one has to admit the ride early on was really scary.

From over a 90% drawdown between 2000-2004 to now becoming the most valuable company in the world. Imagine believing in the trend in the early 2000. Would you have stayed long ?

So for investing in any long term trend the realisation is not enough. One needs to time their exposure in order to stay in the game and sane at the same time. Buy and hold doesn’t work in long term trends if one wants to be in early.

IS PE or VC a solution ? I mean they do tend to lock you in for years so you can ride the long term thematic without visible volatility. The answer is unfortunately not. PE buys cash flow businesses, levers them up and then de-levers via operational efficiency to rerate their assets. Doesn’t work if you dont have a lot of sustainable cashflow, which is the case for most transformational businesses at the beginning. How about VC ? They make risky investments, right ? Well … although better positioned than PE firms, they suffer from that terrible disease called groupthink. Amazon raised a tiny amount of VC capital. Same for a lot of other truly transformational businesses. On top of that most investors cannot really access the good PE or VC funds. Their high minimum entry tickets make them only available to very high net worth investors or institutions.

All is not lost however. Realisation of the existence of a trend and acting upon it means exposure to assets and sectors that will be impacted long term by it. It also means actively managing liquid market risk, keeping your account healthy and yourself sane while still believing (think a bit about Bitcoin volatility). It also means focusing your skills and life to benefit from these trends while actively avoiding the negative effects they may have.

It is not as easy as buying an ETF but why should it be ? When it’s as easy as that you’ve most likely lost a big chunk of the upside and its probably a bit late in the game.

“Follow the Trend Lines, Not the Headlines”

-Bill Clinton

I sometimes post markets commentary along with random thoughts on Twitter. Occasionally I post trading strategy ideas on TradingView or on Telegram. Feel free to connect with me on LinkedIn.