Back to the Future

Or the interplay between foresight and hindsight

Wishing everyone a healthy, meaningful and happy 2025 !

This series of posts cannot really be described as a blog or a column; the highly irregular timing of the posts have killed all my hopes of monetizing this gem of a series and becoming a thought leader or fin-fluencer. I won’t be selling passive income courses and posting social media videos about how to retire at 23.5 years old.

So be it. Having accepted my fate as a second/third tier blogger (not even with a paid Substack subscription ffs !), I have thought today would be good day to look back at some themes I pointed out a few years back - in particular in a post back in 2020 about some very long term trends.

Supertanker Trends

From time to time it is good to leave the analysis of current developments on the side and focus on longer term trends. These trends may affect our way of life in the decades to come as well as determine the long term performance of investment portfolios far more than anything the market may be focusing on right now. Getting straight to the point, the b…

Janus, who was the one of the few Roman gods that did not have an origin from ancient Greece, represents change. He was depicted with two faces, one looking at the past and the other at the future. January is named after Janus and for good reason. The beginning of a new year is a good time for reflection about the past and some planning about the future, notwithstanding the capriciousness of Tyche.

“However beautiful the strategy, you should occasionally look at the results”

Winston Churchill

So in that spirit, let’s look at that old post from 2020 and see if there’s anything to add circa five years later.

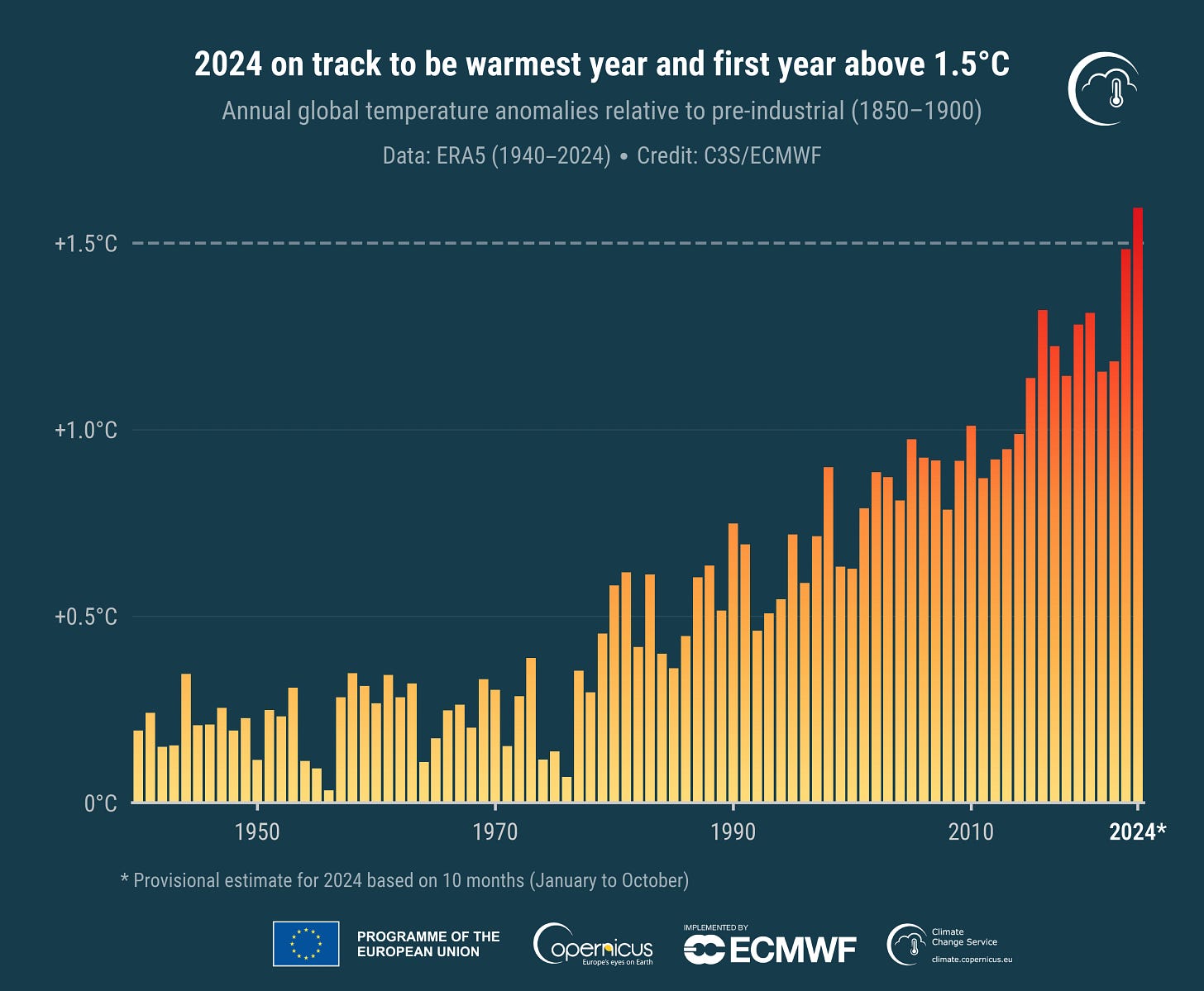

Trend #1 - Climate Change

If anything this trend has accelerated in terms of planet scale weather anomalies. While it is still debatable what causes this climate shift and how we can address this effectively on a global scale, what is undebatable is the amount of “greenwashing” and virtue signaling (at the government, corporate and individual level) on a scale never seen before in human history.

The major issue is that the world has different priorities in different regions. We do not operate as a “human species”. We operate as factions in terms of climate change. I do not see that changing soon - the trend will remain intact. On the back of this one way trend there’s a bunch of opportunities to be positioned long term directly and indirectly.

Trend #2 - Ageing Population

That is a slow but unstoppable trend as well. The world still has population growth but not at the rates curves predicted a few years back. If anything we may be reaching a peak earlier than expected around 2040-50. This following podcast, although commodity focused, is a great listen on the topic.

The ramification of better longevity and less fertility will be a massive thematic for decades to come. Once again multiple angles to play here either directly related or affected by this trend.

Trend #3 - Global Leadership War

Well what can I add here … an AI generated image tells 1000 words ! The trade that keeps on giving volatility to what would be otherwise dull markets. Imagine the VIX levels without this thematic ! Given the current cast of players I do not see any geopolitical alignment soon with massive ramifications for inflation, global debt levels and multiple regulatory positioning & arbitrage opportunities.

Trend #4 - Artificial Intelligence

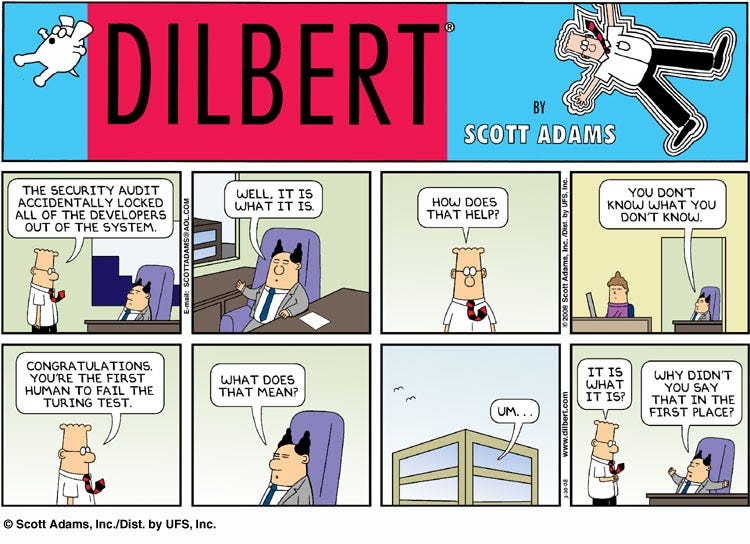

Anyone say NVDA? ARM ? AI everything ? While we are close to reaching the limits of the current LLM stack capabilities we have by far surpassed the original Turing Test criteria. This is an exponentially accelerating trend.

Now the question is, can we achieve true Artificial General Intelligence? Do we want to ? Who will own it ? Can or should anyone own it ? Many questions here but still a massive, albeit super volatile new phase for this mega trend.

For the more technically inclined (geeks) here is a very interesting thesis on the trend by a new fund : https://situational-awareness.ai

This is the one trend that can impact all others, especially if the holly grail of AGI is achieved. You can’t ignore this, whether you like it or not, whether you believe in this or not, you will be impacted sooner rather than later. Ignore at your peril.

Trend #5 - Digital Assets

Ahhh !… The one trend that has more near death experiences that any other ! Volatility, “Concerned” Regulators, the SEC, bankers with nice ties, academics with beards and your uncle that knows everything … they ALL predict with alarming regularity the death of this asset class.

With the new US administration pro digital assets and the biggest fund manager of the world giving institutional credibility it is a trend that will continue unabated. Expect volatility but also expect B2B payments globally to shift to blockchain, passive asset management to become protocols and financial instruments to become code.

Trend #6 - Brain Science

I had the privilege to attend the XPANSE conference in Abu Dhabi last year. If you have read up to now you may have the patience to hear Sir Penrose discuss the link between quantum mechanics and consciousness - the human condition type, not the AGI one. And it led me to think the reason this trend is still not apparent or significant is due to that yet undefined link. We need to understand consciousness to understand the brain. Maybe no matter how good our data capture becomes, it is simply not enough to understand and move forward significantly in this domain. Something to watch but not an area which has shown the breakthroughs that I expected yet.

So what, one may I ask ? Apart from patting yourself on the back for making these calls why should I care ? How do I take advantage without losing my sleep on volatile positions that may take years if not decades to play out ?

Being lazy I will just copy a segment from the 2020 post.

Realisation of the existence of a trend and acting upon it means exposure to assets and sectors that will be impacted long term by it. It also means actively managing liquid market risk, keeping your account healthy and yourself sane while still believing (think a bit about Bitcoin volatility). It also means focusing your skills and life to benefit from these trends while actively avoiding the negative effects they may have.

On the back of this I also have some new ideas this year on how to actively manage directional and tail risk in these supertanker trends - stay tuned !

I occasionally share market commentary and random musings here. None of this should be taken as financial advice - just the ramblings of a trader with some experience. Connect with me on LinkedIn before I leave that platform as well.